As part of the Morning Lazziness series highlighting empowering women who are making a remarkable impact with their ideas, I had the pleasure of interviewing Lauren Anders Brown.

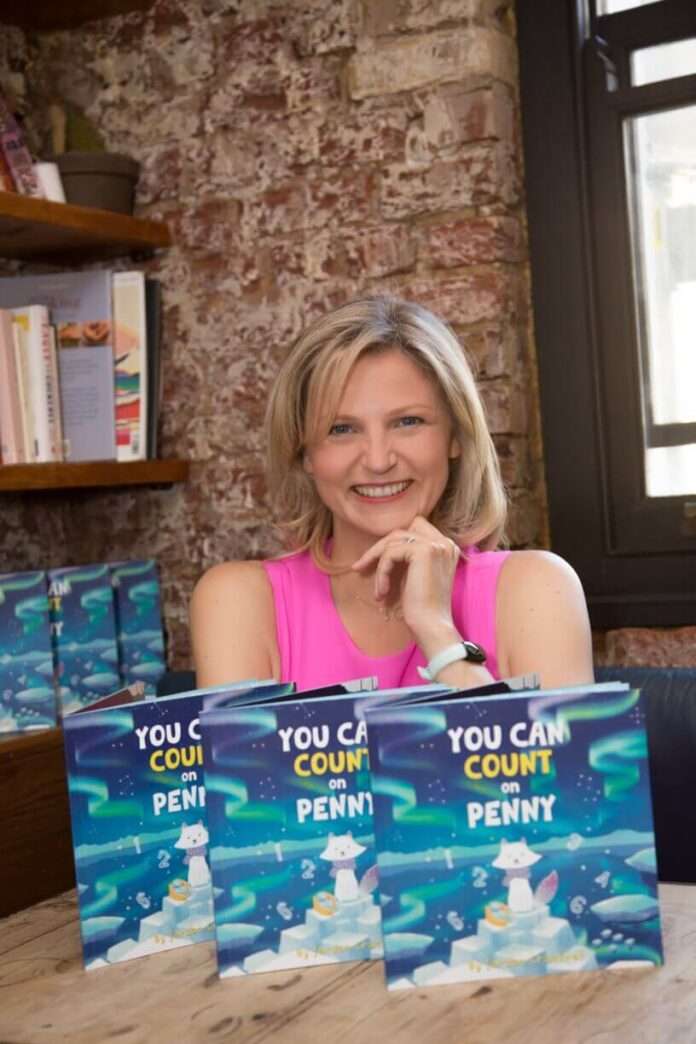

Jordan Cracknell is a UK-based financier, author, and advocate for women in finance. She is the author of You Can Count on Penny, a children’s book designed to spark a love of mathematics in young readers, and her opinion pieces have appeared in leading publications including TODAY.com, Metro.co.uk, and City AM.

A native New Yorker, Jordan holds an MBA from the University of Cambridge and an MSc in Finance from Baruch College. Her passion for finance was first ignited during “Take Your Daughter to Work Day” with her father at the World Trade Center, an experience that inspired her to pursue a career in the industry.

Jordan’s career spans investment banking and trading, with experience at global firms such as Deutsche Bank and Renaissance Capital. From building pitch books straight out of university to thriving on fast-paced trading floors, she has forged a dynamic career while championing greater representation for women in finance.

Now living in the UK with her husband, double Olympic gold medalist James Cracknell, Jordan balances her professional pursuits with stepmotherhood, writing, and mentoring. She is dedicated to empowering the next generation to confidently manage money, pursue careers in finance, and break barriers in the industry.

In this interview, she reveals the mindset shifts, bold moves, and lessons that helped her turn ideas into impactful online businesses.

What first drew you to the world of finance, and how did you find your path to becoming CEO of a global financial services company?

My father worked in finance, and so when I was younger, he would take me to the office. During my university years, it wasn’t on my radar as a potential career path. At that time, I worked in event planning for large-scale events, for clients such as Land Rover and the US Open. Our office happened to share an office with an investment bank. After graduating, my mom suggested I ask them for a job. So I marched on over to the head guy and I got hired! It was kismet. I loved working in finance, and through networking, I found the job I have today!

As a woman leading in a male-dominated industry, what have been the biggest challenges—and how have you turned them into opportunities?

You have to be confident and sure of yourself, even when internally you don’t feel that way. Everyone has self-doubts, and it took a while for me to figure that out. I thought it was just me! During my first year of work, I mostly felt awkward and out of place. I was my own worst enemy. Over time, those feelings disappeared. There are only so many times you can feel uncomfortable about things. It is similar to exposure therapy; the more you do something, the less scary it becomes.

You’re often the only woman in the room—what mindset shifts or strategies have helped you thrive in those moments?

I viewed the men I worked with as brothers and treated them as such. It helped immensely with interpersonal dynamics.

What misconceptions do you think hold young women back from exploring careers in finance?

That it is for men only. This is only from years of social conditioning. The reality is there are many intelligent and capable women working in finance already. There are incredible women who speak multiple languages, who run large teams, from countries all around the world working in finance right now. Go onto LinkedIn and start networking and reaching out to these amazing women! You will learn so much!

How can women become more financially empowered, even if they feel intimidated by investing or managing their finances?

The internet is your friend! YouTube and The Khan Academy have amazing and free resources for those new to the world of finance. The library is always another option.

What are some practical, everyday actions women can take to build financial literacy and independence?

Be inquisitive and take action, whether by asking someone for help, taking a class, watching a video. Believe in yourself!

In your view, what untapped opportunities currently exist for women in the finance industry?

Fintech and crypto-related segments in financial services are worthwhile learning about only because the regulatory environments for these are changing in certain countries such as the United States. Major banks now have divisions focused on these. Similarly, AI applications within the financial sector are being embraced in day to day to operations. Anytime there is a new technology, it engenders opportunity. And even if the segment itself fails, going after a new opportunity is a way to get one’s foot in the door.

What inspired you to write You Can Count On Penny, and why was targeting young audiences important to you?

We know already that children start thinking about career goals surprisingly early, around the age of seven. Having conversations about careers in the lead up to this can be inspiring and help them discover a career they might not be aware is possible for them.

I undertook some research via a OnePoll survey. A third (32%) of the parents I studied have a child that loves maths. Yet more than eight in ten parents have never discussed with them their children how maths can lead to a career in finance. They Parents described a lack of the right resources and role models available to help them feel more comfortable to do so. Over a quarter of parents (27%) also believe that the finance industry is better suited to men than women.

Having looked into books available, and finding a lack of a ‘little miss banker’-type stories for children, I decided to combine my love of writing with my passion for advocating for more women in finance and created You Can Count on Penny as a tool for both parents and stepparents to open up conversations about careers, in a fun way with a book that children can love.

How do you hope your book will shift perceptions about who “belongs” in finance-related careers?

I hope readers are encouraged by little Penny and her love of numbers and math! At the end, she saves the day!

The proceeds from your book go to Education and Employers—why was it important for you to align with this cause?

I liked what they stood for. They run the “Primary Futures” programme, which helps children understand the link between their education and future careers. I felt it was a good fit! Their vision is providing children and young people with the inspiration, motivation, knowledge, skills, and opportunities they need to help them achieve their potential.

After two decades in finance, what are three key money lessons you wish everyone—especially women—knew?

Build a detailed budget encompassing every possible expenditure. Make certain your expenses are in line with your income and stick to it. Revisit it every year, preferably with your financial advisor.

What role do you think confidence plays in financial decision-making?

I think it is massive. One must be confident when it comes to making your own financial decisions. Otherwise, it invites others to make those decisions for you, and at the end of the day, you are your own best cheerleader.

How do you balance your demanding career with your personal life, especially as the spouse of a high-profile athlete?

I try to keep a very organized schedule! It helps that James also has that same mind-set. We have a good flow between us in managing home stuff and work stuff. James loves to go food shopping and cook, while I do more cleaning. We make a good team.

If you could give one piece of advice to your younger self about money and career, what would it be?

Be more confident.