As said, maintaining a budget plan might sound like a lot of work. However, it is not as tedious as you think.

With the pandemic’s start, everyone has been going through some type of economic disruption. According to financial experts, it is always important to have control over your money.

Budgeting should be on your mind at all times. While you can choose to maintain handwritten records, there are better options available for you to use. Financing apps are a great choice and are gaining a lot of popularity lately.

If you’re searching for a way to track your spending and build better saving habits, budgeting apps should be your go-to. Here, we have curated a list of the best budgeting apps to manage personal finances. With the right app, you can keep tabs on your spending and reduce unnecessary expenses.

Top 5 best apps to manage personal finances

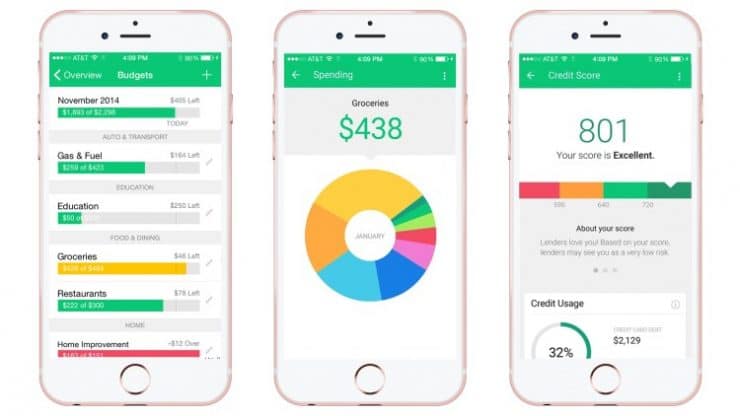

Mint: Best budgeting app overall

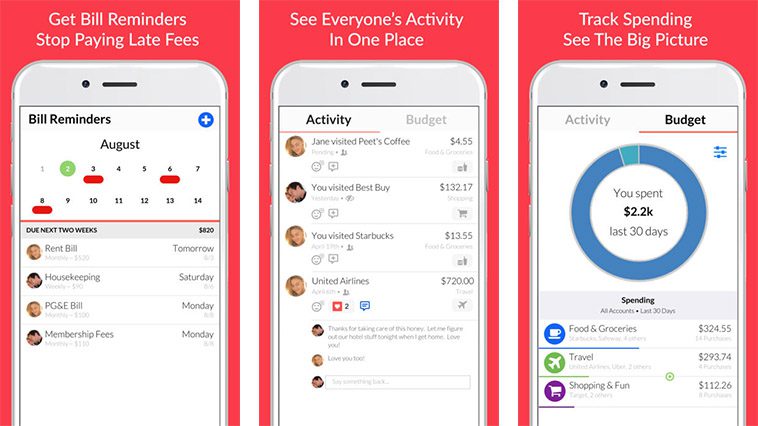

Mint is one of the most popular personal finance apps that provide you with a different financial picture. With around 25 million users, Mint is free and is perfect for all levels of budgeters. The bill payment reminders can be set up, and you can track the investments. You can manually add transactions or sync all the financial accounts. It shows payment reminders so you can avoid late fees. It also offers some educational content like a home affordability calculator and blogs about finance-related topics. It is one of the best apps which stands out for a few reasons.

PROS

- It is a free budgeting app.

- It has Free TransUnion credit scores.

- You can track your investments.

CONS

- You will find multiple in-app product advertisements.

- Some complaints are found about technical issues.

- The categorization of the spending could be better.

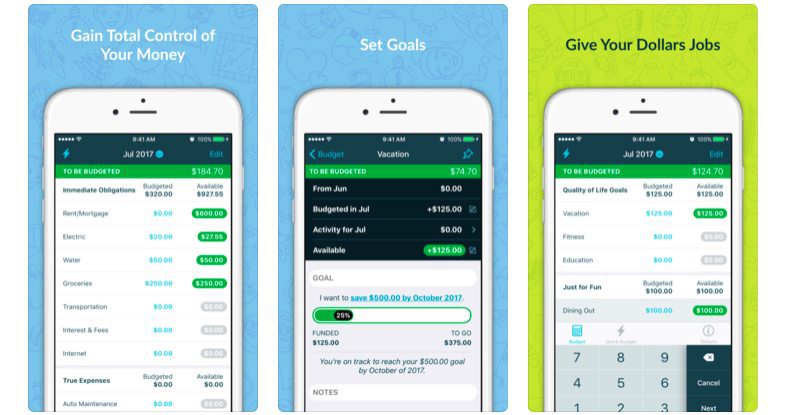

YNAB (You Need A Budget): Best Budgeting App Overall

YNAB is a personal finance app that centers around four rules. The rules are: Give every dollar a job, embrace your true expenses, Roll with the punches and Age your money. These rules help you to build a better budget based on your goals. You can easily import transactions to get the right picture of your spending. It also shows detailed reports of your progress throughout the month. According to the app, an individual can save $600 in the first two months and around $6000 in the whole year. This is, however, not a free app but comes with a 34-day free trial.

PROS

- Will provide you with a complete budget makeover.

- Comes with a free 34-day trial period.

- It has a strong customer service base and offers comprehensive education.

CONS

- It costs $84 per year.

- It takes time to learn the process.

- Many users have reported syncing issues.

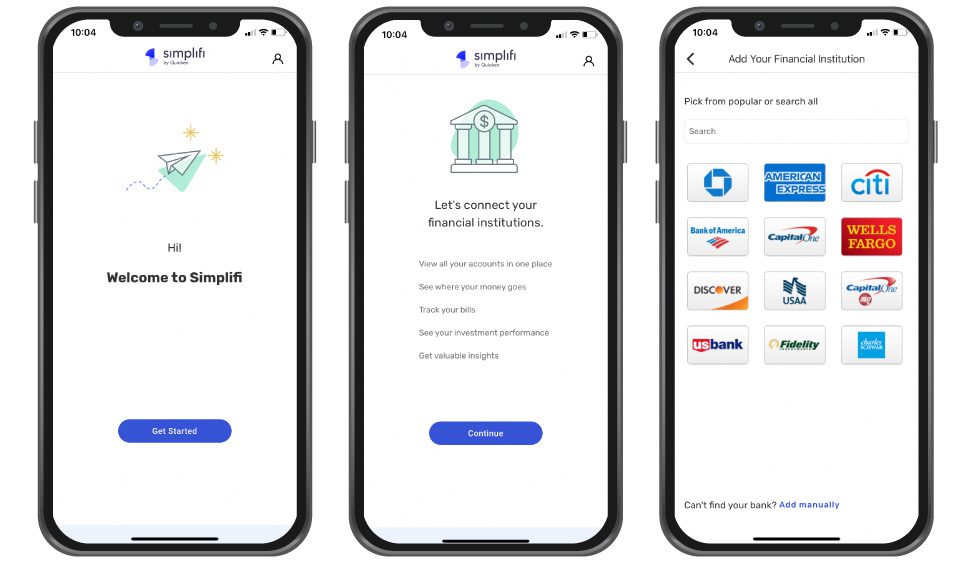

Simplifi by Quicken: Best for Cash Flow

Simplifi is made by Quicken and is one of the most effective apps for budgeting. It offers a free trial period of 30 days and costs $2.99 or $3.99 per month. One standout point of this app is the custom watchlist feature which allows you to control your spending based on categories. The spending plan makes sure you never have to spend more than what you make. The app comes with multiple tips and blogs surrounding the educational aspects of finance. The top priorities of this app include security and privacy, and Quicken continues to work on the measures.

PROS

- Provides a strong set of cash flow tools.

- Customized watch lists for some mindful spending.

- Offers a free 30-day trial period.

CONS

- It costs $35.99 per year.

- Users have complained about certain technical issues.

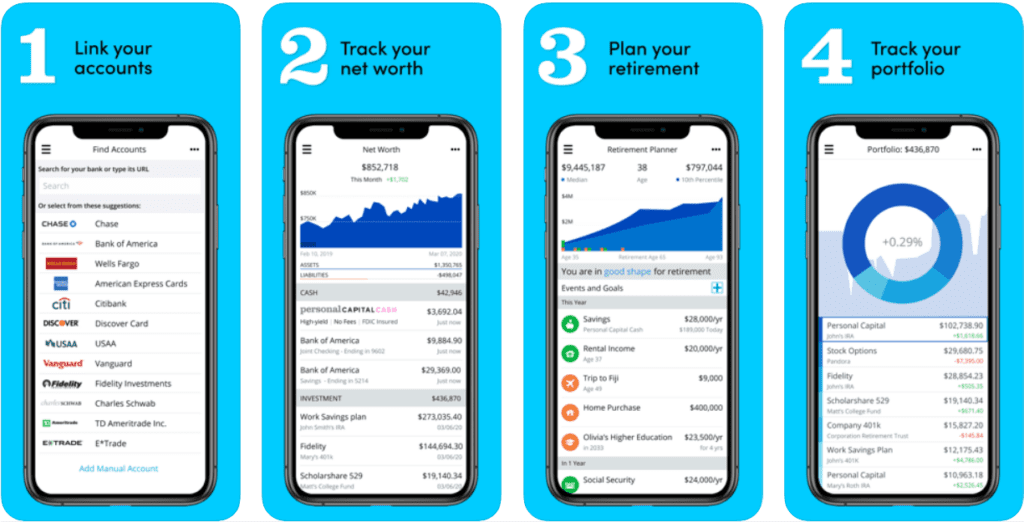

Personal Capital: Best for Overspenders

For anyone trying to focus on wealth building, Personal Capital is a great place to start. You can easily sync all your financial information and check out your net worth. Using the information, you can go ahead and plan the future with a Retirement Planner, and also check the portfolio fees using the Fee Analyzer. The primary app is free, but you get the option to add an investment management service for 0.89% of the money in accounts under $1 million. The app doesn’t allow any manual budgeting transactions. You can plan for the future using the Retirement Planner or save for your future studies using the Education Planner tool. Personal Capital protects your data with the help of encryption and offers strong authentication tools.

PROS

- Provides a free wealth management app.

- Includes the Retirement Planner tool.

- Includes the Education Planner tool.

- You can avail the net worth tracking features.

- It comes with a Fee Analyzer tool to check out the portfolio.

CONS

- It is less focused on budgeting.

- There is no option for manually adding translations.

- You might receive sales calls for different wealth management services.

Honeydue: Finance App for Couples

Household finances are a completely different area that is often overlooked. As a couple, you can use the Honeydue app for better communication with transparency about the expenses and other finances. Couples can chat about the transactions inside the app and pair it with automated bill reminders. A joint account can be opened, which is FDIC insured by the Sutton Bank. The account comes with zero fees and a free debit card, which can be used to access 55,000 surcharge-free ATMs, Google Pay and Apple Pay. Both the partners will receive instant notifications after every transaction is made.

PROS

- The app is free.

- It offers a chatbox where you can chat with your partner.

- A joint account feature is available.

- Around 20,000 financial institutions are available from which you can extract financial information.

CONS

- The desktop version of the app is not available.

- There are no features available that can track the progress of your financial goals.

- You will not receive any reports or analysis.

When we’re talking about our personal financial life, the right budgeting apps can make a huge difference. Make sure to list down your goals and needs while choosing a budgeting app. With the right insights and data information, you will be able to increase the overall net growth.